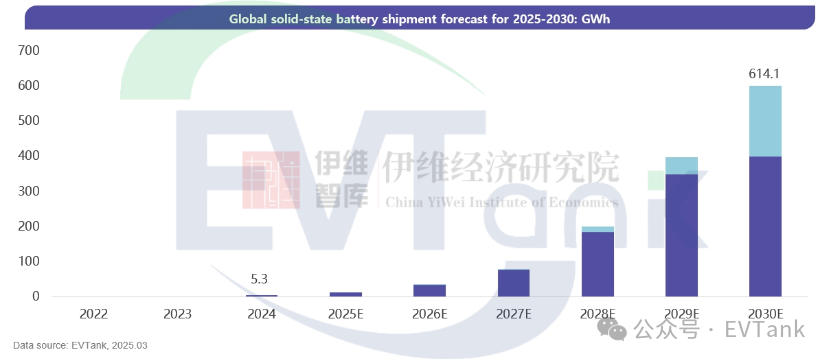

Recently, research institution EVTank and China YiWei Institute of Economic jointly released the “White Paper on the Development of China's Solid-State Battery Industry (2025).” According to EVTank data, global solid-state battery shipments reached 5.3 GWh in 2024, a significant increase of 4.3 times YOY, all of which were semi-solid-state batteries, mainly produced by Chinese companies.

EVTank expects all-solid-state batteries to achieve small-scale mass production by 2027 and larger-scale shipments by 2030. The“White Paper on the Development of China's Solid-State Battery Industry (2025).” forecasts that global solid-state battery shipments will reach 614.1 GWh by 2030, with all-solid-state batteries accounting for nearly 30% of the total.

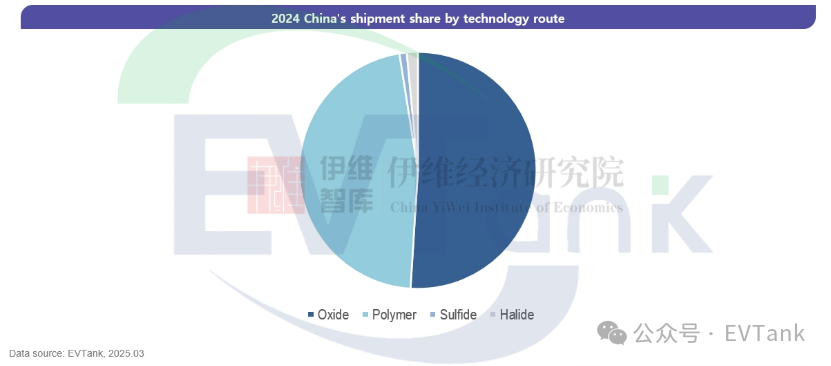

EVTank points out in its white paper that polymer electrolytes and oxide electrolytes are mainly used in semi-solid-state batteries currently, while sulfides and halides will be mainly used in all-solid-state batteries in the future, and a small portion will be used as additives in semi-solid-state batteries.

In 2024, polymer and oxide electrolytes accounted for more than 98% of shipments in China, and sulfides and halides were used in small portion..

EVTank expects that as all-solid-state batteries gradually become commercialized, the shipment share of sulfide electrolytes will gradually increase. By 2030, the overall shipment share of sulfide electrolytes is expected to reach 29.5%, among which the market share of sulfide electrolytes in all-solid-state battery electrolytes will reach 65%.

EVTank summarizes in its white paper that solid-state batteries are emerging with unstoppable trend and becoming a new battlefield for competition in the field of new energy. Companies and major R&D platforms are continuously tackling existing issues of solid-state batteries, such as improving ion transport through doping and interface engineering, and addressing lithium dendrite growth through additives, coatings, and structural design.

In addition, with the introduction of AI, the paradigm of material research and development has changed, greatly improving the efficiency of all-solid-state battery research and development and increasing the possibility of realizing the industrialization of all-solid-state batteries ahead of schedule.

In the “White Paper on the Development of China's Solid-State Battery Industry (2025)” released by EVTank, the report also analyzes and forecasts key materials for solid-state batteries, production processes, cost-reduction strategies, the current landscape of solid-state battery companies, technological advancements, and the future market prospects for solid-state batteries.

White Paper Framework:

Chapter 1: Basic Characteristics of the Solid-State Battery Industry

I. Definitions and Classification

(1) Definition of Solid-State Batteries

(2) Classification of Solid-State Batteries

II. Advantages of Solid-State Batteries and Industrialization Bottlenecks

(1) Analysis of the Advantages of Solid-State Batteries

(2) Analysis of Technical Challenges in Solid-State Battery Technology

(3) Industrialization Bottlenecks for Solid-State Batteries

III. Research on the Solid-State Battery Industry Chain

(1) Industry Chain Structure Diagram

(2) Changes in the Upstream Material System

(3) Downstream Application Areas

Chapter 2 Research on the Current Status of the Solid-State Battery Industry in 2024

I. Analysis of Global Solid-State Battery Industry Policies in 2024

(1) Analysis of Overseas Industry Policies (Europe, America, Japan, and South Korea)

(2) Analysis of China's Industry Policies

II. Analysis of Global Solid-State Battery Shipments and Market Size in 2024

(1) Analysis of Global Solid-State Battery Shipments

(2) Analysis of Global Solid-State Battery Market Size

III. Analysis of China's Solid-State Battery Shipments and Market Size in 2024

(1) Analysis of China's Solid-State Battery Shipments

(2) Analysis of China's Solid-State Battery Market Size

Chapter 3 Analysis of the Current Status of Solid-State Battery Technology Development

I. Technology Route Analysis

(1) Semi-Solid-State Battery Technology Route

(2) All-Solid-State Battery Technology Route

II. Process Flow Analysis

(1) Liquid Battery Process Flow Analysis

(2) Semi-Solid-State Battery Process Flow Analysis

(3) All-Solid-State Battery Process Flow Analysis

III. Cost Reduction Path Analysis

(1) Semi-Solid-State Battery Cost Reduction Path Analysis

(2) Cost Reduction Pathway Analysis for All-Solid-State Batteries

IV. Patent Layout Analysis for Solid-State Batteries

V. Analysis of Key Characteristics in the Development of Solid-State Battery Technology in 2024

Chapter 4 Analysis of Core Materials for Solid-State Batteries

I. Solid-State Electrolytes

(1) Polymer Electrolytes

(2) Oxide Electrolytes

(3) Sulfide Electrolytes

(4) Halide Electrolytes

(5) Comparative Analysis of Solid-State Electrolytes in Different Systems

II. Cathode Materials

(1) High-Nickel Ternary Materials

(2) Lithium-rich manganese-based materials

(3) Other high-voltage materials

III. Anode Materials

(1) Silicon-carbon anode materials

(2) Lithium metal anode materials

IV. Other Materials

(1) Conductive agent materials

(2) Other materials

Chapter 5 Analysis of the Competitive Landscape of Solid-State Batteries in 2024

I. Regional Competitive Landscape

(1) Solid-State Battery Layout in Different Countries Around the World

(2) Solid-State Battery Layout in Different Regions of China

II. Corporate Competitive Landscape

(1) Solid-State Battery Layout of Automobile Manufacturers

(2) Solid-State Battery Layout of Battery Companies

(3) Solid-State Battery Layout of Start-up Companies

(4) Cross-Industry Layout of Solid-State Batteries by Other Companies

III. Analysis of Characteristics of the Solid-State Battery Competitive Landscape

IV. List of Enterprises in the Solid-State Battery Industry Chain

Chapter 6 Analysis of Key Enterprises in the Solid-State Battery Industry

I. Toyota

(1) Company Overview

(2) Technology Roadmap and Main Products

(3) Production Capacity Layout

(4) Key Partner Clients

II. Welion

(1) Company Overview

(2) Technology Roadmap and Main Products

(3) Production Capacity Layout

(4) Key Partner Clients

III. Ganfeng

(1) Company Overview

(2) Technology Roadmap and Main Products

(3) Production Capacity Layout

(4) Key Collaborative Clients

IV. Qingtao

(1) Company Overview

(2) Technology Roadmap and Main Products

(3) Production Capacity Layout

(4) Key Collaborative Clients

V. Samsung SDI

(1) Company Overview

(2) Technology Roadmap and Main Products

(3) Production Capacity Layout

(4) Key Collaborative Clients

VI. Solid Power

(1) Company Overview

(2) Technical Approach and Main Products

(3) Production Capacity Layout

(4) Key Partner Clients

VII. QuantumScape

(1) Company Overview

(2) Technical Approach and Main Products

(3) Production Capacity Layout

(4) Key Partner Clients

Chapter 7 Analysis of the Development Trends of the Solid-State Battery Industry from 2025 to 2030

I. Analysis of the Development Trends of Solid-State Battery Technology

(1) Technological Development Trends

(2) Material System Development Trends

II. Shipment Volume Forecast for Solid-State Batteries

(1) Shipment Volume Forecast for Semi-Solid-State Batteries

(2) Shipment Volume Forecast for Fully Solid-State Batteries

III. Market Size Forecast for Solid-State Batteries

(1) Market Size Forecast for Semi-Solid-State Batteries

(2) Full Solid-State Battery Market Size Forecast

IV. Solid-State Battery Competitive Landscape Forecast

(1) Regional Competitive Landscape Forecast

(2) Corporate Competitive Landscape Forecast

V. Investment Opportunities and Risk Analysis in the Solid-State Battery Industry Chain

(1) Investment Opportunity Analysis

(2) Investment Risk Analysis

2. Introduction to the joint publishers of the white paper

EVTank: A leading global third-party institution specializing in research on electric vehicles and related industries, providing independent and authoritative professional research services to all stakeholders, manufacturers, purchasers, suppliers, investors, banks, and governments. www.evtank.cn

China Yiwei Institute of Economics : A third-party think tank established in accordance with the law under the support of the national competent authorities, specializing in research and consulting in the field of emerging industries. The institute has established specialized research centers such as the Automotive Industry Research Center, the Energy Conservation and Environmental Protection Industry Research Center, the Electronics and Information Industry Research Center, the Intelligent Manufacturing Industry Research Center, and the New Energy and New Materials Industry Research Center. The institute primarily serves governments, enterprises, and financial institutions, offering professional services such as industrial planning, investment promotion services, market research, industry analysis, enterprise management consulting, investment and financing consulting, and feasibility studies. The institute's headquarters is located in Beijing, with branches in Shanghai, Shenzhen, Chongqing, and other regions. www.yiweiresearch.com

China Battery Industry Research Institute: An independent research institution headquartered in Beijing, specializing in research and consulting services for the new energy battery industry chain, as well as big data research and development. The institute is committed to providing clients with authoritative, independent, and professional third-party industry research reports and data.